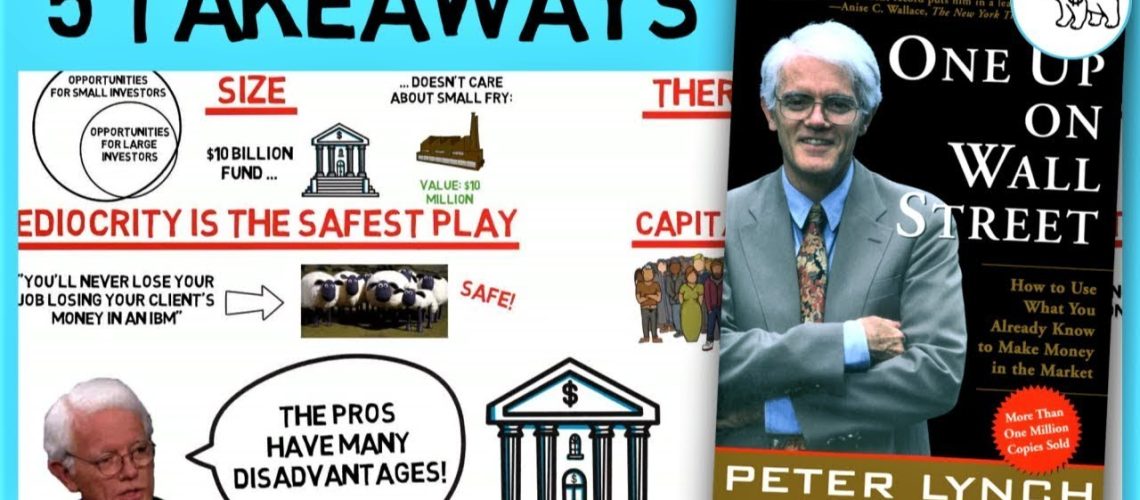

In this video the Swedish Investor presents the top 5 takeaways from One up on Wall Street, the bestselling book by legendary investor and manager of the Fidelity Magellan mutual fund, Peter Lynch.

Key Takeaways

In One up on Wall Street, the legendary investor Peter Lynch reveals how his amateur approach to investing has led him to become one of the most successful investors of all time.

1. Why the individual investor can beat the pros.

Surely the amateur doesn’t stand a chance against the might of Wall Street?

Doesn’t Wall Street have a ton of analysts from the fanciest Ivy League schools working 80 hours every week to find bargain stocks?

Surely there can’t be any left for the amateurs, right?

Here are a few of them:

Size. A successful money manager will naturally attract a lot of capital, and more capital means less opportunities.

For instance, a $10 billion fund cannot invest in a company with a market cap of $10 million and expect the investment to have a meaningful impact on the fund’s overall performance.

Mediocrity is the safest play. There’s a saying on Wall Street that “you’ll never lose your job losing your clients money in an IBM.” Meaning that, if you’re just another sheep in the herd, you’ll get to keep your job.

Capital is dependent on clients. As a fund manager is investing other people’s money, other people are also deciding how much money the manager has at disposal.

This leaves the manager with the following dilemma: He has a lot of money to invest when everything is expensive, and too little of it when everything is cheap.

2. If you like the store, chances are you'll love the stock.

If you’re a software engineer, a cashier at the local mall, a professional musician, a surfer, a fast food addict or a crazy cat lady, you have an edge over Wall Street. Wait … Whaaaaat?

Let me explain:

"If you like the store, chances are that you'll love the stock."

Think about it! Which products do you enjoy and use from publicly listed companies?

Here’s a list of some of mine:

- Spotify An awesome Swedish music streaming service, which I use for 1 to 2 hours a day. I love to use it when I work out, and I’ve spent about $120 on it during the last year.

- Pepsi This summer the new flavour Pepsi Lime was released in Sweden and I’ve been a complete addict of it lately. I probably drink three of them every week or so, so I spend more than $200 on these every year.

- Amazon. Well, I’ve probably been their best customer of 2018, as I buy all the books that I read for this channel from them. Not only that, but I prefer buying both the Kindle and the audio if possible, as I’ve found that I can finish the books in half the time that way. On a yearly basis I spend $1,500 or more for this service.

When you’re looking for investment opportunities this way you must always remember to check how much the product or service that you enjoy affects the bottom line for the company.

- For example, sure, I’m an addict of the new Pepsi Lime flavor, I admit it. But let’s say that this product only makes up 2% of the company’s total profits. Then it doesn’t really make sense for me to buy Pepsi based on me loving the Pepsi Lime.

3. The 6 categories of stock investments.

Peter Lynch argues that there are 6 different categories of stock investments.

1. Slow growers

This company is typically large and operates in a mature industry.

The growth of the company is expected to be in the low single digits of percentages. If you invest in such a company, you typically do it for the dividends.

2. Stalwarts

3. Fast growers

These are aggressive new enterprises, growing at 20% or more per year.

They’re often priced thereafter, but if you can conclude that a company is likely to be able to keep up the growth for several years, it can be a great investment.

Always remember to verify your assumptions regarding the growth rate though.

- For instance – if Amazon can keep up its revenue growth rate of 30% per year for the next 10 years, its revenue will be equal to the GDP of France in 2029! Is this reasonable?

4. Cyclicals

Cyclicals are companies whose revenues and profits rise and fall with the business cycle.

Typically, they produce services and/or products that the consumers will postpone consumption of in times of financial uncertainty.

5. Turnarounds

The turnarounds are potential fatalities – companies with declining earnings and/or problematic balance sheets.

If the company doesn’t go down and instead manages to flourish once again, stock owners are rewarded thereafter.

A situation where a company has gotten a temporary bad reputation is usually a profitable turnaround case.

6. Asset plays

Situations where the value of the company indicates that the market has missed out on something valuable that the company owns are asset plays.

Such undervalued assets could be: real estate, patents, natural resources, subscribers, or even company losses (as these are deductible from future earnings).

- Take McDonald’s for example. It’s gone from being a fast grower, to a stalwart, to an asset play to slow grower.

4. 10 traits of the tenbagger.

A tenbagger is the expression that Peter Lynch uses to describe a stock which has appreciated to ten times your purchasing price. If you have a few of these you in you’re investing lifetime, you’ll become a legend.

Here are 10 positive signs for a stock, regardless if it’s an asset play or a fast grower.

1. The company name is dull, or even better, ridiculous. Such companies tend to be overlooked. The pros of Wall Street will think twice before bragging about their recent investment in “Maui Land and Pineapple Company Incorporated” It just sounds way too ridiculous!

10. The company is buying back shares. If a company has faith in itself, it should invest in itself. Peter Lynch prefers share buybacks for dividends.

5. 5 traits of the reversed tenbagger

1. It’s in a hot industry. As previously mentioned, everyone is looking for ways to get into the hot industries. Competition is typically a bad omen for profits.

2. It’s “the next” something. Beware when someone expresses that it’s the next Amazon! The next Facebook! The next Google! Or similar. Usually, it’s not.

3. The company is diworseifying. Some call it diversification, but Lynch likes to refer to it as diworseification. If the company is acquiring other companies in unrelated industries, stay away!

4. It’s dependent on a single customer. Some companies are relying on one customer for a significant share of profits. Usually, this is a weak bargaining position to be in, and the company can potentially be squeezed by this only customer.

5. It’s a whisper stock. These are the long shots, often thought of as being on the brink of doing something miraculous, like curing every type of cancer, completely removing any addiction or creating world peace.