If you are an investor and you want to optimize your stock market returns, it isn’t enough just to pick the right stocks - you must also know how to combine different stocks into a portfolio to maximize potential upside and minimize potential downside.

Video by The Swedish Investor

Key Takeaways

"We think diversification - as practiced generally - makes very little sense for anyone that knows what they’re doing."

Warren Buffett’s Portfolio – Then and Now

In 1941, an 11-year-old Warren Buffett purchased his first shares. He bought three preferred shares of a company called Cities Service, for a total of $114.75.

However, a few years later, when Buffett was 19, his mind would change a bit. This was the time when he read The Intelligent Investor, and later went to Columbia Business School to learn value investing from Benjamin Graham.

"You will find opportunities that, if you put 20% of your net worth in it, you’ve wasted the opportunity of a lifetime. You know, in terms of not really loading up."

In 1962 he stated: We usually have fairly large positions (5% to 10% of our total assets) in each of five or six generals [which was what Buffett called one type of investments in the partnership], with smaller positions in another ten or fifteen.

In 1966 he said: We probably have had only five or six situations in the nine-year history of the Partnership where we have exceeded 25%. And also… We presently have two situations in the over 25% category – one a controlled company [Berkshire], and the other a large company [American Express] where we will never take an active part.

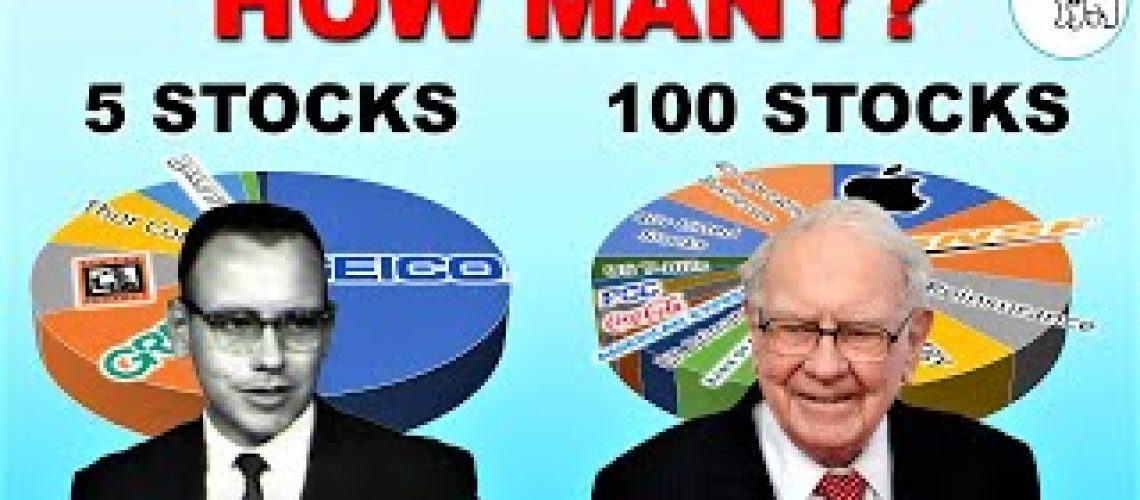

From this, I think that we can safely conclude that, back then – Buffett liked to stay focused. However, if we fast forward to today, we wouldn’t get the same picture. Warren Buffett owns more than 40 listed companies and more than 50 wholly-owned operating subsidiaries.

It is quite difficult to state what his current portfolio looks like, as most of these companies aren’t listed, but that won’t stop me from trying.

According to my calculations, and you can find some assumptions in the description of the video, Warren Buffett’s current portfolio looks like this. Still quite top-heavy, but not at all as concentrated on a few companies as he was back in the days.

"We’ll never get a chance to do that working with the kinds of money that Berkshire does. We try to load up on things. And there will be markets when we get a chance to from time to time, but very seldom do we get to buy as much of any good idea as we would like to."

So, no, Buffett would love to operate a concentrated portfolio today too. It’s just that, when he is only looking at the elephants of the business world, he seldom finds that one of them is both understandable and undervalued.

1. Are You a Know-Something Investor?

I mean, if you want to make sure that nothing bad happens to you relative to the market, you own everything. There’s nothing wrong with that.

"I mean, if you want to make sure that nothing bad happens to you relative to the market, you own everything. There’s nothing wrong with that. I mean, that is a perfectly sound approach for somebody who does not feel they know how to analyze businesses. If you know how to analyze businesses and value businesses, it’s crazy to own 50 stocks or 40 stocks or 30 stocks, probably."

The know-something investor has done things such as:

- Looked through the financial statements of the companies he invests in

- Researched the management and owners of the companies

- Understood who the main competitors of the industries he is in are

- Compared the price of his investments to other opportunities in the stock market

Note that this can vary from industry to industry or country to country by the way, you might be very knowledgeable about American stocks but not so much about Swedish ones.

"By periodically investing in an index fund, for example, the know-nothing investor can actually out-perform most investment professionals. Paradoxically, when “dumb” money acknowledges its limitations, it ceases to be dumb."

2. Are You Investing in Risky Assets?

Even at the roulette tables, where the casino has a mathematically computable edge, diversification is needed. Therefore, there’s a limit to how much you are allowed to bet there.

"Risk with us – well - it relates to several possibilities. One is the risk of permanent capital loss. And then the other risk is just an inadequate return on the kind of capital we put in. It does not relate to volatility at all."

The stock market is obviously not as quantifiable as the casino.

In terms of “riskiness”, what you need to watch out for are securities where if you are wrong, you are likely to lose everything in that holding.

Here are a few such situations:

- Startups

- Bankruptcy cases

- Industries with a lot of flux

- Pretty much anything involving leverage

You should also watch out for correlations between your holdings.

For example, even if your portfolio consisted of 20 different horse carriage companies when the Ford Model T arrived, your diversification wouldn’t help you much, you would have been smoked anyways.

3. Are Some Opportunities Much Better Than Others?

"And to have some super wonderful business and then put money in number 30 or 35 on your list of attractiveness and forego putting more money into number one, just strikes Charlie and me as madness."

If you are a know-something investor you should be able to judge the attractiveness of individual opportunities, not everywhere, but at least within your circle of competence.

4. Can You Earn It Back?

"You will see things that it would be a mistake if you’re working with smaller sums - it would be a mistake not to have half your net worth in."

This is the fourth rule of thumb – the less capital that you are working with the fewer stocks you need.

It depends on where you are in your investment career and how much you earn.

When we are starting to talk about sums of money which takes a couple of years to earn back through your everyday work though, then you must really start to consider diversification. An extreme case would be if you’ve just inherited a large lump-sum of money.

Applying This to My Own Portfolio

- Are a know-something investor

- Are buying assets that have a low risk of adverse outcomes

- Expect a large difference in returns among the opportunities you’ve found

- Can replace your capital fairly quickly through income