In this video summary of Poor Charlie’s Almanack, you will learn about the greatest investing advice from the right-hand man of Warren Buffett – Charlie Munger.

Video by The Swedish Investor

Key Takeaways

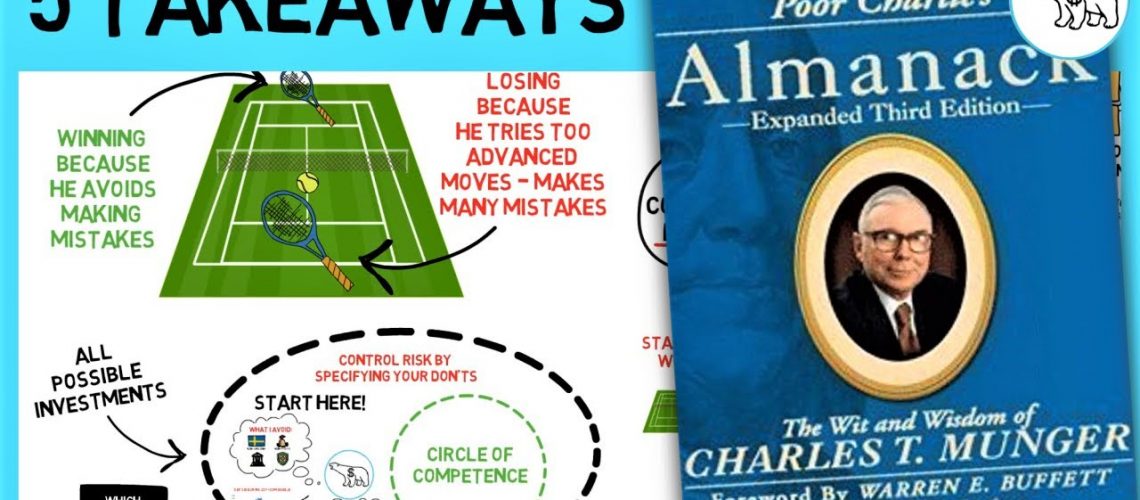

5. Start With the Don'ts

According to Charlie, this also holds for life in general. And more importantly – for investing.

One important part in this process is to limit yourself so that you know what your circle of competence is.

In the process of finding where you can create yourself this edge, you should start in the other end – by choosing which markets and industries to avoid.

- For example, I have tried to avoid companies based outside of Sweden, companies that don’t yet make a profit, banks and insurance companies, to mention a few.

In the process of finding where you can create yourself this edge, you should start in the other end – by choosing which markets and industries to avoid.

- For example, they sailed quite smoothly through the dot-com bubble.

Starting with the don’ts is one of Charlie Munger’s favorite mental models, and he has been quoted saying:

"All I want to know is where I'm going to die, so that I'll never go there".

And again, this model can be used when playing tennis or chess, when finding a suitable spouse, or choosing an education or job.

By simply removing the worst alternatives, and thus playing in a way so that you don’t lose, you will be a big winner in investing and in life in general.

4. "Lollapalooza"

Charlie Munger is known to have coined the term “Lollapalooza effect”.

With this, he means an outcome that is extraordinary. Where 1+1=3.

A Lollapalooza effect is created when an outcome is much bigger than the sum of its parts. One positive effect enhances the power of the next one, and on and on and on.

You want to invest where there’s a possibility for such self-reinforcing loops.

- For example: One of the greatest brands in history was created through a lot of Lollapalooza effect by combining the factors of a great product, two powerful stimulants, clever marketing, ease of availability and social proofing.

Which brand do you think it is? It’s coca-cola, of course.

Not only has coca-cola completely dominated the market of soft drinks, it’s also the most widely distributed physical product in the entire world.

But how can this be? It’s just a regular soft drink?

"The brain of man yearns for the type of beverage held by the pretty woman he can't have".

All these systems at work pulling in the same direction have created the Lollapalooza effect for coca-cola and an incredible moat to keep competitors from nagging on Coca Cola’s market share.

However, Charlie points out that identifying where and when these Lollapalooza effects can happen is difficult, because it requires a multidisciplinary approach.

3. Learn from other peoples' mistakes

One of the ingredients for great misery is to learn everything you possibly can from your own mistakes, instead of learning from other people’s experiences – both living and dead people.

A little bit less dramatic, but still a fatal mistake for an investor, is the tendency for people and companies to fall into bankruptcy due to financial leverage.

If you instead start with learning from others, preferably from the masters within the field you wish to accelerate in, you will find yourself make headway much faster than walking on every mine by yourself.

So, study history: what made great people great? And look around you: what is it that slows people down? And when within a certain field – climb the shoulders of giants.

"If I have seen a little further than other men it's because I stood on the shoulders of giants"

2. Become a Swiss army knife

On the internal side, you have products, people, processes, incentives, culture leaders and so forth.

On the external side, you have an ecosystem with laws and regulations, competitors, suppliers, buyers and macro trends and so forth.

Have you heard about the man with a hammer syndrome?

But you will also need to understand history, psychology, politics, mathematics, engineering, biology, business law, statistics and so on.

A great way to excel in these major fields is to read her lots. Charlie Munger puts it this way:

"In my whole life. I have known no wise people who didn't read all the time".

"Just as multiple factors shape almost every system, multiple models from a variety of disciplines, applied with fluency, are needed to understand that system".

1. Charlie Munger's investing checklist

Charlie Munger has a very structured mind, and so is his method when it comes to investing.

He says that no wise pilot, no matter how great his talent and experience, fails to use his checklist, and this goes for investing as well.

Charlie Munger’s checklist for investing Risk:

All investments should begin by measuring risk.

- Use a margin of safety

- More risk requires additional compensation

- Avoid big mistakes and permanent capital loss

Independence: only in fairy tales are emperors told they are naked.

- Think for yourself. You cannot stay objective and rational while listening to Wall Street hogwash

- That people are agreeing with you doesn’t make your analysis correct, nor does people disagreeing with you make it wrong

- Mimicking the herd will give you the results of the herd

Intellectual humility: Acknowledging what you don’t know is where you should begin.

- Stay within your circle of competence

- Identify and think through evidence that goes against your own view

- Above all, never fool yourself

- And remember that no one is as good at it as you are

Allocation: Proper allocation of capital is an investor’s number-one job.

- Remember that there’s always an opportunity cost

- Good ideas are rare

- When the odds are greatly in your favor – bet heavily

- Don’t “fall in love” with an investment. Stay sceptic

Patience: Resist the human bias to act.

- Compound interest is the eighth wonder of the world, never interrupt it unnecessarily

- The process is where you live, so remember to enjoy it along with results

- Guard against the effects of hubris and boredom

Decisiveness: When proper circumstances present themselves, act with decisiveness and conviction.

- Be fearful when others are greedy and greedy when others are fearful

- Opportunity doesn’t come often, so seize it when it does

- Stay prepared. Opportunities can only be identified by those who are