In these videos, the Swedish Investor goes over the top 10 takeaways from “The Wealth of Nations” by Adam Smith.

Key Takeaways

Adam Smith was a Scottish economist, philosopher and author, and a very successful one at that.

His masterpiece, The Wealth of Nations was released in 1776 and was at that time considered very controversial, but it has laid out the groundwork for pretty much all economics since.

Smith is often referred to as “the father of economics” or “the father of capitalism” for good reasons.

The Wealth of Nations main message is probably that we must trust in incentives. Adam Smith was a pragmatist who knew that people will always act in their own self interests, and therefore, every economic policy introduced must always take that into account.

Secondary and tertiary effects must always be considered. A society can do no better than to set up the correct incentives so that humans will act in the best way possible.

This is a top 5 takeaway summary of The Wealth of Nations, written by the father of economics Adam Smith.

1. Productivity is King

- First, an increase in the number of people who have a job compared to those who don’t.

- Secondly, an increase in the productivity of those jobs. This could be said to increase their “wealth”. It depends much more on the latter than the former.

Consider this story:

A man was handed the task of inspecting the construction of a waterway in a certain communistic land.

When he arrived at the site, he saw a thousand people digging with spades while great digging machines stood idle nearby.

He asked the manager of the project: “Why don’t you use the machines over there instead?

“Well, sir, that’s because these people would be unemployed in no time!”

To the wealth of a nation, productivity is king. It is improved by three factors primarily:

- Dexterity or skill in doing something

- Avoiding loss of time changing from one task to another

- Proper use of machinery

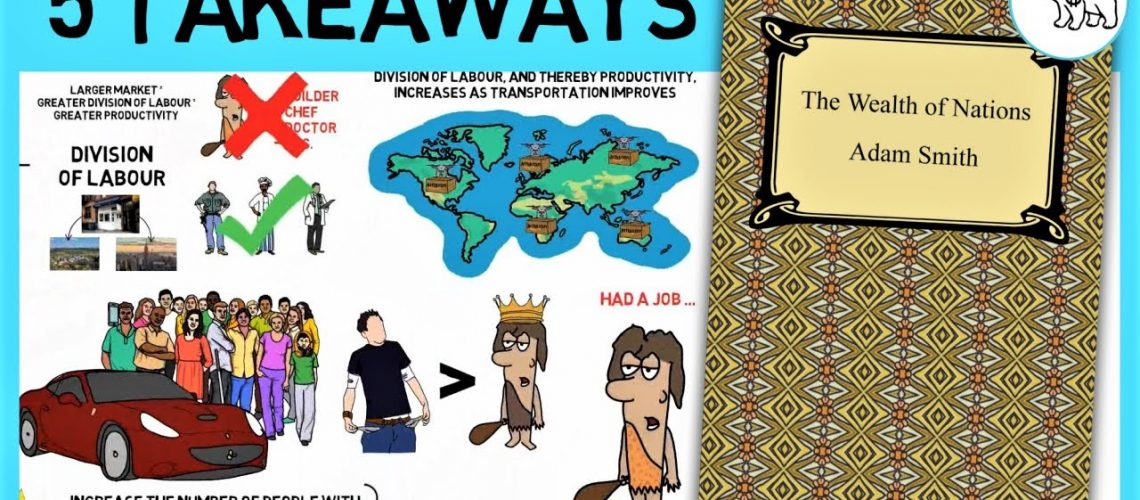

Instead of having everyone in a society doing everything themselves, we should each do what we are best at, and then trade products and services with each other.

The greater the extent of this trade (or the greater the market) the greater the possible division of labor and thereby the greater the productivity.

Just think about all the specialized products and services that we exchange with each other in a great city. You would probably not find a store like this one in a small country village, but in the great city of New York, you can.

The division of labor increases as transportation is improved.

- Adam Smith gives an example from his experience in the 18th century: 6-8 men can, by water carriage, transport the same amount of goods in the same time with a single ship as 100 men with 50 broad wheeled wagons and 400 horses.

This is why rivers and sea coast towns often develop faster. They allow a greater division of labor as they extend the market of trade.

So … Ships were much better than horses, but I think that Adam Smith would be jealous if he looked at us today, because now we have Amazon!

2. Money: What is it, and why do we use it?

But in the beginning, it must have been very inefficient to try to trade with one another when supply and demand didn’t always match.

Hey Randy! Look at this nice spear that I just created! Could I get like a pound or two of your salt if I give you my spear?

No deal Bob. You know that I’m too old to go hunt these days, but I could use a new shirt.

Hey George! Look at this nice spear that I just created! Could I get a shirt if I give you my spear?

Yeah, of course Bob. I’ll be happy to trade a spear for a shirt Nice!

Oh, but I think that one spear is probably worth more than one shirt. How many shirts have you got?

I only have one shirt to spare at the moment, unfortunately. Well, then no deal George! This was quite inconvenient to say the least.

Enter: Money.

Quite early, metals were used as money and they have at least two qualities which make them suitable for this purpose:

- They basically do not perish and they can be divided into many parts and then fused again.

Some things have value in use – like spears, meat, salt and shirts.

Other things have value in exchange – like bills, coins and metals.

That which has high value in one, often is quite worthless from the other standpoint.

- You can’t use a dollar bill for anything. I mean you can’t eat it or anything. Similarly, a spear might be quite useful but it doesn’t work well for exchange, as we just saw.

As long as people trust that money can be exchanged for something else that they are in need of later, they are happy to trade their own produce for that money.

It all boils down to that: Trust.

Warren Buffett has said that it is quite misleading that on the backside of every dollar bill, it says “in god we trust” Because, what it should actually say is “in The Federal Reserve we trust”.

3. The three components of price — Part I

The real price of everything is its price in labor.

Something that takes more time, energy or resources to bring up often has a higher real price.

- Bob didn’t want to make that final deal with George because he thought that his spear had a higher real price than George’s* shirt.

However, there’s also a nominal price and that is the price as measured in money. Because it’s difficult to measure and compare labor, we’ve come to estimate real prices in terms of money instead.

The price of everything that is produced resolves itself into either one or more of the following three components:

- A wage, to pay the labor who did the work.

- A profit, to pay for the capital that was laid out for the work to happen.

- A rent, to pay the holder of the land where the work and or exchange must take place.

We all know that wages can differ a lot between different occupations. Just look at the average salary of a McDonald’s cashier and compare that to the salary of a neurosurgeon.

Similarly, profits differ from industry to industry, but not as much, and also they should average out over time, something that we’ll get to later.

These are the average profits measured as return on equity for different industries during the period 1999 to 2019. And the factor that can differ the most is of course rents.

- In New York, for example, you’ll have to pay about $5,200,000 per acre of land, while in the country village of Eksjö in Sweden, you’ll pay only about $20,000.

How much you have to pay to buy land correlates well with how much rent you can get for it.

Because of this, the proportions that make up the price of a certain product or service differs a lot depending on its type and where it is bought.

- A massage for example costs $60 an hour in the previously mentioned Eksjö, while it costs $105 an hour on Manhattan in New York.

The difference in price between the two locations can pretty much fully be contributed to the difference in rents. And some of it in the difference in wages that are necessary to sustain someone in New York.

The price of a certain product or service is determined by the supply and demand.

Actually, it is determined by something called the “effectual demand”, which is those that demand the product at a price so that it allows for the wages of workers, the profits and replacement of capital of businessmen, and often some rent for landowners.

I mean .. I want a Tesla. It’s just that i’m not ready to pay $70,000 for it yet. Thus i’m a part of the demand, but not the effectual demand, that can actually bring the product to the market.

4. The three components of price — Part II

Let’s have a look at these three components separately.

A worker will always demand a wage so that he can at least purchase the necessities of life for himself and his family.

This is the bare minimum which even the simplest type of job must pay, because otherwise, such workers will cease to exist over time.

In countries where no minimum wages exist, the simplest jobs will tend to be at this level and not higher.

This is because workers are at a natural disadvantage when trying to bargain how much of that price which was mentioned earlier which should go towards their salary.

They typically exist in abundance compared to capital and land and moreover, they typically do not have much money spared so they can’t afford to wait for a better opportunity.

But salaries can differ a lot which we shall see later.

A businessman is someone who employs his capital to earn a profit within a specific trade or industry. The more capital that is employed in a certain industry, the higher the competition there becomes, and the lower the profits tend to be.

So it must be in society as a whole too. If there are no intelligent ways to employ capital anymore, returns will be low.

Over time, even though some companies can hold on for very long, returns on capital will even out across industries.

This is because where returns are high, there will be incentives to move capital, and where returns are low, there will be incentives to remove capital. This restores an equilibrium of sorts.

- If you want to know more about which types of industries that can withstand competition the longest, head over to the summary of “Competitive Strategy”.

An owner of land will either try to sell his land for a profit or lend it out for a rent.

Either way, someone down the line will eventually try to lend it out for a rent, or use the land themselves, and then it is they who gain the rent.

Rents vary A LOT depending on location. Some types of land basically afford no rent at all, while those that people find attractive—land in cities or beautiful beach properties—earn a lot of it.

Something that should be noted is that rent is quite like a monopoly price.

After normal wages have been paid and the businessman have been able to replace his capital with a decent profit, the owner of the land will pretty much take what’s left.

Land is immovable and irreplaceable, and is therefore peculiar compared to the two other types of revenues that can be earned.

5. Why some jobs pay more than others do

The wages of labor are decided by supply and demand, like everything else.

The following five factors tend to affect this to increase the wages of a specific job.

1. The expenses and difficulties of learning it.

2. The inconsistency of payments.

3. The trust and responsibility.

4. The improbability of success.

5. The hardship, dirtiness, and disagreeableness of the job.

In the 18th century a blacksmith had to be an apprentice for many years before he was allowed to open his own trade. During this time, he earned very little or basically nothing at all.

The higher wage that he got once finished is a compensation for those years, and the apprenticeship helps in limiting the supply of such workers.

A mason could only work during good weather conditions, and so his hourly wage had to be compensated for those idle hours.

A greater responsibility means that fewer people are suited for that type of work and therefore wages are higher.

- Back in the days, lawyers and doctors had such roles (and they still have by the way).

The improbability of success is another factor that matters.

The expected wage of a job with a very high fail rate is often even lower than normal jobs, but the person who succeeds typically gets the salary of those who fail too (kind of).

People searching for gold or treasure belonged to that category.

And in the 18th century the most dirty and disagreeable job one could possibly get was probably that of the public executioner, and the pay was thereafter.

Today, a difficult and expensive job to get would be that of the previously mentioned neurosurgeon. An inconsistent one might be that of a real estate broker.

A job which requires a lot of responsibility. is that of a pilot.

Improbability of success is high among elite athletes and musicians.

Part II

Key Takeaways

6. Accumulation and employment of capital

What’s the similarity between Michael and a country like the US, China or Sweden? It is that they get wealthy in the same way.

Allow me to introduce The Swedish Investor’s “Stairway to Money” All copyrighted and original content, of course. Each different step represents a category that an individual can spend money on.

To become wealthy a person wants to spend money on the higher steps and not the lower ones.

Stairway to Money

At the bottom, we have services meant for consumption.

These are the worst things that you can spend your money on, as you’ll consume them instantly.

- Vacations, dinners and video on demand all belong to this category.

The next worst thing to direct your money towards is products meant for consumption.

Products depreciating value from the time of purchase, but at least they’re not as bad as services because you will still be able to sell them at a later stage, even though it may only be at a fraction of their original value.

- Cars, clothes and phones belong to this category.

Then we have products that do not depreciate in value and that often keep their value through inflation.

Important entries in this category are collectibles and a house to live in.

And at the top, we have investments.

- Therefore – starting a business, educating yourself, investing in the stock market, or renting out properties all belong here.

It’s the same with countries.

If a country buys products from another country, at least some of the value is still preserved as products can be sold again at a later stage. It is similar with a third step in our Stairway to Money.

A country gets rich by increasing its own productivity by starting businesses there, by educating its people so that their skill and dexterity increases, or by buying productive assets from other countries BUT … … and this is unimportant but, neither people nor nations should be afraid of having expenses just because of this.

Both people and nations, if they want to acquire wealth, should focus on what they are naturally good at and then outsource the rest. This is what we shall focus on next.

7. Globalization – the shortcut to increased wealth

Given this, here comes a few questions for you:

- Should Michael cook his own food?

- Should Michael clean his own house?

- And, sorry now i’m getting a bit silly just to prove a point here, should Michael build his own phone instead of buying one from Apple?

From a wealth standpoint the answer is no to all of these questions.

It makes sense for Michael to do what he is best at, earning money from that and then hire other people to do what they are best at for everything else that he demands.

Perhaps Michael can cook his own food, but it takes him about an hour to prep a single meal, which means that he does so at a cost of $30, because he could have spent that time working as an engineer. Therefore, it doesn’t make sense for him to do it as he can just buy a meal outside for $15.

Similarly, he can clean his own house, but it takes him 2 hours to do. So that’s $60 for Michael, while he can hire someone to do it for $40.

And as an engineer, he is capable of building his own phone, but it might take him something like 200 hours plus $200 in materials. That’s a $6,200 phone! Why not just go buy the latest IPhone for $1,000?

If it doesn’t make sense to do something at 6 times the price it doesn’t make sense to do so at 2 times the price, and probably not at 1.5 times the price either.

It is the same with nations.

For nations to increase their wealth, they should be focusing on the things that they are really good at, and then hire other nations to do what they are best at.

- For example .. The US is obviously a leader in many different businesses, but among others, in the fast food and entertainment industry.

- China is incredible at producing most products at very low prices.

- And in Sweden, we are quite good at producing furniture …… sorry, I mean at making everyone else produce furniture for themselves, of course.

Now, should Sweden try to produce the same products that China can produce much cheaper? No.

Should China compete head-to-head with Hollywood? Probably not.

Should the US have everyone produce furniture for themselves? Definitely not!

All these countries can be more productive, and in that increase their wealth, by simply doing what they are best at, and then trade goods with each other.

Also, to make another comparison between individuals and countries in their quest for wealth: Both of them will earn more by having rich neighbors or acquaintances.

People know that if they want to be rich, they should move where other people are rich. And probably even more importantly – they should acquire rich friends.

It’s the same with nations.

A country should want their neighbors and trading partners to be wealthy, because eventually that wealth will spill over to them, too. (Just look at the map in the video.)

But we’ve been getting this backwards for centuries now.

In the 18th century, Great Britain and France, probably the two wealthiest countries in Europe at that time, did everything they could to make business miserable for each other instead of cooperating. They even went to war with each other!

Today, let’s hope that the two most important economies of our time, the US and China, don’t make that same mistake.

8. Why free trade is superior, and why government shouldn’t interfere

As talked about in Part I – in a capitalistic society, money will naturally flow where the returns are higher and disappear from where their returns are lower.

In a society where the government does not interfere, two rules will guide capital:

1. Capital is naturally employed where it can produce the greatest returns.

- This is actually a good thing, because businesses like these are more sustainable than anything else. They will employ people where there is demand and a real competitive advantage.

2. Capital is also naturally employed in the home market, as this comes with less risk.

- This is also good, because it creates working opportunities in the own country.

For these two reasons, it is totally unproductive when governments interfere with the market.

Just as an imaginary example: Say that we, in Sweden, would do something as silly as setting up a ban on movies created in Hollywood. What would happen when such a ban is introduced?

Excluding potential retaliation, it will yield higher profits for the film industry in Sweden than what would naturally be the case. Therefore, more capital will be incentivized to flow to this industry.

But this business still isn’t competitive on a global scale. Everywhere else than in Sweden, people will still watch movies from Hollywood!

Moreover – the capital in Sweden which goes towards the creation of film is capital that could have been directed towards something where Sweden is competitive on a global scale, like the previously mentioned furniture.

Generally, politicians must have a small dose of God Complex if they think that they are smarter than the aggregated thinking of the market when it comes to capital allocation decisions in businesses.

There are two examples when it might be necessary to introduce duties, bans and tariffs though:

1. For goods that are important for the defense or survival of the country.

2. When a tax is imposed even on such domestically produced goods. You don’t want to shift the favor to the foreign goods, at the very least.

Apart from that, governments should probably stay away from using duties, bans and tariffs on foreign goods.

They should not incentivize certain industries or disincentivize others, because the market is likely to do this very well on its own, thanks to the before mention two.

There are a few areas where a government is absolutely necessary for the wealth of a nation though, and that is what we shall cover in the next takeaway.

9. What’s the purpose of a government?

According to Adam Smith, there are some tasks in a society that the market and private people have little or no interest in solving.

The four that Smith discusses are:

1. The defense of a country

2. The justice system

3. Some type of infrastructure

4. And basic education

1. The defense of a country

The defense of a country is absolutely necessary for its wealth to increase. Interestingly enough, a country is more and more likely to be invaded the richer it is. Or so it was in the old days at least.

- Consider the raids of Genghis Khan and his Mongolian savages of the much wealthiest cities of China.

- Or how the vikings invaded many much more established societies in Europe.

- The savages actually had the advantage at this time, as they were much more skilled fighters.

- But that all changed with the invention of the firearms. Firearms were expensive to make, and no matter how skilled an army of spears and bows were, it couldn’t beat one equipped with firearms. And so, the odds changed in the favor of the wealthy nations, who could afford these supreme weapons.

Anyways … A nation must be able to defend itself to sustain its wealth. And as this benefits everyone in a society, it does make sense that a government has the responsibility of this task.

2. The Justice System

Justice, is similarly an expense that benefits everyone in a society.

In the old days, justice was often exercised by those in power, but one can easily understand how such a system can be very corrupt.

It is essential that justice and power are separated. Otherwise — who should bring justice to those in command?

Similarly, a justice system that is based on profits tend to be very corrupt too, so it doesn’t lend itself well to the free markets.

It used to be like this too, everyone that wanted justice had to bring a gift to the judges. As you can probably imagine, the person who brought the greatest gift tended to get a little bit more “justice” than everyone else … So to speak.

Therefore, the task of bringing justice to its people should be paid for by a government. But those that use the justice system often should probably pay extra for that.

3. Some type of Infrastructure

Infrastructure, such as the most important roads and docks used for commerce of a country, is something that benefits everyone too. But it doesn’t invite the same conflict of interest as the justice system does, and should thereby often be held privately.

Infrastructure should be financed with revenue from the commerce which can be carried by means of it. Because in this way, money will much more seldom be wasted on infrastructure projects.

Some infrastructure projects can be important without being profitable, but in that case they should often come with a local tax, not a national one.

4. Basic Education

Without some type of basic education being free and probably also mandatory, some of the country’s inhabitants, those that are born into poverty, will most likely never learn how to read, write or count.

Such inhabitants are unlikely to increase the productivity of a nation. Therefore, we want to avoid that this happens.

A benefit such as learning to read, write and count benefits everyone and it should be one of the purposes of the government of making sure that this is done.

10. How should a government be financed?

So .. with defense, justice, infrastructure and education, a publicly financed government seems to be the most fair and logical solution. But there are many different options of financing something, and some are definitely better than others.

Here are 4 principles for creating good taxes:

1. Equality

Each person should contribute in proportion to his or her abilities and in proportion to the revenue which he earns under the protection of the state.

It is difficult to make sure that the wages, profits and rents (the three sources of income is discussed in Part I) are all taxed equally, but they should at the very least be taxed equally individually.

2. Certainty

Time, quantity and manner of payment must always be clear. This is probably the most important principle.

A little bit of uncertainty is worse than a great deal of inequality. Uncertainty leads to the potential corruption of the tax gatherer.

3. Convenience

Taxes should be due when the contributor is most likely to be able to pay.

The consumer pays whenever he consumes a service or product, and the wage earner should pay taxes as soon as he gets the wage, not at some other time when he might already have spent it all.

4. Efficiency

A tax may never be more burdensome to the people than it is beneficial to the government.

For instance — As few people as possible should be required for gathering the tax — A tax should never discourage industry – And the degree of visits and examinations of the people shouldn’t make them feel oppressed.