The Surprising Secrets of America's Wealthy

Animated Video Summary by the Swedish Investor

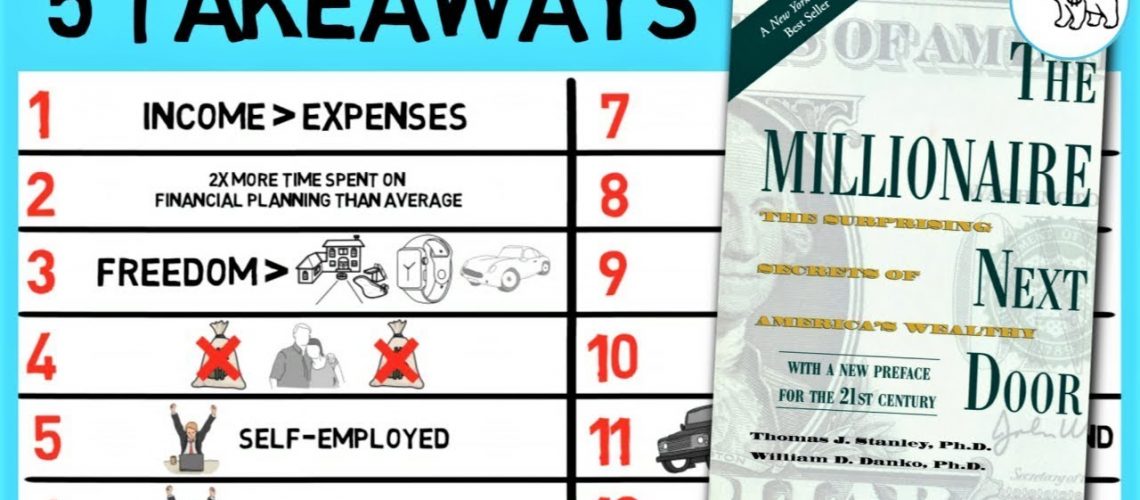

Key Takeaways

The typical millionaire doesn’t live in Beverley Hills, they live next door. What can we learn from these peoples so that we also one day, may call ourselves, millionaires?

1. The 12 Characteristics of a Millionaire

Contrary to many people’s beliefs, it’s rarely luck or inheritance that decides whether you will be a millionaire or not. It’s much more a result of hard work, lifestyle decisions, planning and self-discipline.

Let’s pretend that we can interview the millionaire population. This is what they would tell us:

- We live below our means.

- About 50% of us have lived in the same house for more than 20 years.

- Our time, energy and money are allocated towards wealth.

- We spend more than twice the amount of time on financial planning and investing as our non millionaire friends.

- We think that freedom and financial security are more important than displaying high social status.

- We never received cash gifts from our parents.

- We are self-employed.

- About 2/3 of us have ourselves as our bosses.

- 75% of us consider ourselves entrepreneurs.

- Most of us are in our 50s and are males.

- We have a go-to-h**l-fund, which means that we can keep our lifestyle for 10 years or more, without bringing in additional income.

- We are well educated.

- Only 1/5 of us aren’t college graduates.

- We invest a lot!

- On average, about 20 percent of our realized income per year, and we make our own investment decisions.

- We invest in the long run.

- Over 90 percent of us hold our investments for more than a year.

- We buy cars by the pound. And screw those environmentalists!

- We are cheapskates. In a good way, we would argue.

2. Play Defense

Let’s do a quick quiz:

- Does your household operate on an annual budget?

- Do you know how much your family spends each year on food, clothing and shelter?

- Do you have a clearly defined set of daily, weekly, monthly and lifetime goals?

- Do you spend a lot of time planning your financial future?

- Did you answer yes to all the above?

Millionaires, to a greater extent than others, do. Now you probably think: Hold on a second! Why would someone who’s a millionaire need a budget? To that, the answer is: Because they became millionaires that way and they maintain their affluent status the same way.

A parallel could easily be drawn to training. Have you seen all the You Tubers who go to the gym every day? They are the ones who seems not to need it, right? But that’s why they are fit! Becoming and staying financially independent is not much different from that.

So how do you play great defense then? For starters, you should buy (or rent) a house in a modest neighborhood, not an upper-class one. The price tag of an apartment or Manhattan for instance even though, I know, it’s stunning, does not factor in all the variables. To live there it’s expected that you have a certain lifestyle. This lifestyle might be even more expensive in the long run than the apartment itself.

Live in a modest (but safe) area instead and you will find it easy to keep up with, and even stay ahead of, the Joneses and still accumulate wealth.

In general, spend as little as possible on consumables and spend smart on possessions that will depreciate in value. To be honest, most millionaires do both. They have a decent offensive as well as quality defense. But only a minority plays such good offensive that they can eat their salary and keep it too. If you don’t belong to that category, which only is 0.1% of us do anyway, learn how to play defense.

3. The True Cost of Consumption

Let’s disregard all the costs that a certain purchase might result in later, as explained through the apartment on Manhattan example in our last takeaway. The price tag still does not fully represent what you pay when buying something.

There are two reasons as to why this is not true.

1: The opportunity cost, the monetary one. An opportunity cost is the loss of other alternatives when one of them is chosen.

- Let’s pretend that you had an iPhone 6 in November 2017. Now, if you like most people, you upgrade your phone every second year or so. So now you’re thinking about the new iPhone X. Even though the price tag was hard to swallow to begin with ( $999 dollars for a phone?) you haven’t yet factored in opportunity costs.

- If you choose to buy the iPhone X you miss the opportunity to invest your money, for instance, in the stock market. At an annual 10% in returns, the price of your new phone is: $2,591 after 10 years. $6,720 after twenty years. $117,000 after fifty years. Now, do you still want to buy that new phone?

- Cigarettes (yeah, yeah, it’s a cliche, I know) are an even greater example. At least your iPhone X doesn’t affect your life expectancy negatively. If you, instead of smoking 3 packages of cigarettes every day, invested the money in the tobacco company Philip Morris, during the time period of 1950 to 1996 you would have been a multimillionaire at the end of the period.

2: The opportunity cost of time. To acquire and maintain large inventories of luxury goods such as fancy cars, expensive clothing and so on, does not only require money, but also a lot of time. You don’t buy a Ferrari without first studying the market.

- Neither can you keep a high profile wardrobe without investing a lot of time in understanding the latest trends, the greatest brands, and so on. This is time that could have been used to increase your financial intelligence, to improve your business or to set up a proper budget for your household instead.

- Time and energy of finite resources, even for high-income producers. Or perhaps especially for high-income producers. Why would you spend 60 to 80 hours a week at a job trying to become wealthy and then spend the remaining few hours of the week, ruining this same wealth? It’s like trying to build a house during weekdays, but then bringing in the wrecking ball on the weekends. Do you think that you’ll ever be able to raise a house with that strategy?

4. Cash Gifts Are Bear Favors (Disservices)

A bear favor is a Swedish expression of someone doing another person a service that they think will have a positive impact but which ends up being a disservice instead. Well, I guess the English expression for it is just disservice… Takeaway number 4: Cash gifts are disservices?

Nah! Every wealthy parent, or actually every parent, wants their children to be prosperous and successful in life. How do wealthy parents make sure that their kids get a head start? Well, they provide them with extra money of course! This proves to be counterproductive though. In fact, in general, the more dollars adults children receive the fewer they accumulate.

Adults who sit around waiting for the next injection of father and mother’s money are much less productive than their counterpart. Cash gifts teach children to live above their means. Gift receivers have in 80% of the instances a lower net worth than their peers.

Adults who get money from their parents have a hard time to distinguish between their parents wallets and their own. In fact, more often than not, they think that they belong to the “I did it on my own club”. It’s much easier to spend other people’s money than dollars that are self generated.

So, in case you’re wondering, what can you give your kids that will increase their likelihood of becoming prosperous and successful? The single most common gift millionaires received from their parents is tuition.

Apart from that try to create an environment where independent thoughts are cherished and where achievements, responsibility and leadership are rewarded. Yes, the best things in life are often free.

5. How to Decide if You Are on the Right Track

Now, are you on your way to become financially independent, or are you actually going in the opposite direction, towards a life of credit cards and Spotify Freemium accounts?

Your expected net worth can be estimated using the following formula: Age x realized yearly pre-tax income / 10 = net worth. Exclude any inherited wealth both on the yearly pre-tax income and your net worth.

Let’s take a few examples:

- The Swedish Prime Minister, Stefan Löfven, earned approximately $220,000 last year at an age of 61. This means that his net worth should be 61 x 220,000 / 10 which is … $1,342,000.

- An engineer at Volvo who recently was promoted to the rank of middle manager is earning $70,000 at the age of 30. His net worth should be 30 x 70,000 / 10. $210,000.

- A student at Stockholm School of Economics is in his last Bachelor year of study. He’s 23 years of age, but earns nothing. This means that his net worth should be 23 x 0 / 10 …. Oh, well, I guess that the formula doesn’t apply to students. Student’s can just keep on partying every night.

Now, this is just your expected net worth. But you guys aren’t here to be average. Am I right? Above the ranks of the “Average Accumulators of Wealth” are the “Prodigious Accumulates of Wealth” if you want to be a part of that exclusive club you must gather a fortune that is twice the amount of what the formula suggests.

But it doesn’t end here. Above this exclusive group are the “Super Prodigious Accumulators of Wealth” To join this club of glorious elites, you must have a wealth that is 10 times higher than the formula explained before. Now that requires dedication!

If you are, on the other hand, only worth half of what the formula says that you should be worth, you belong to the “Under Accumulators of Wealth”.