The Rich Dad's Guide to Financial Freedom.

Animated Video Summary by The Swedish Investor

Key Takeaways

This book will change the way you think about jobs, careers, and owning your own business and inspire you to learn the rules of money that the rich use to build and grow their wealth.

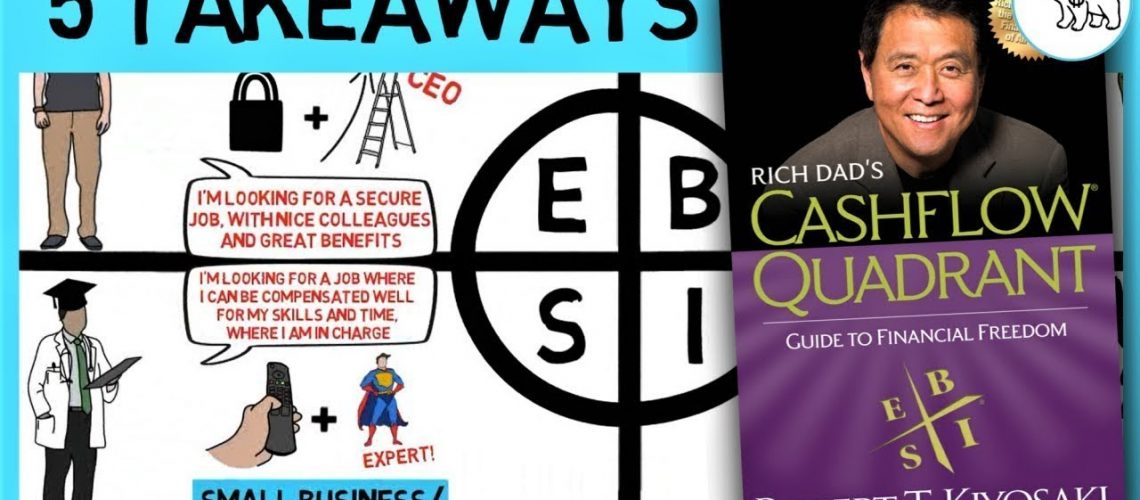

In Rich Dad’s Cashflow Quadrant, Robert Kiyosaki explains that there are 4 different paths to become wealthy, but some of them are more efficient than others …

1: The Cashflow Quadrant

The cashflow quadrant is a simple model that explains that wealth can come from 4 different sources. Which quadrant you belong to depends on where most of your income comes from.

The 4 different quadrants are:

E – the employee The employee strives for security. He achieves financial success by climbing the corporate ladder, and you might find him say something like: “I’m looking for a secure job with nice colleagues and great benefits.”

S – the small business owner or self-employed. The small business owner or self-employed, on the other hand, strives for control. He achieves financial success by becoming highly specialized in a demanding field, and you might find him say something like: “I’m looking for a job where I can be compensated well for my skills and time where I am in charge.”

B – the big business owner The big business owner strives for freedom. He achieves financial success by creating a profitable business system, and you might hear him say something like: “I’m looking for people that are smarter than me to run my business for me.”

I – the investor The investor also strives for freedom, but he does this through allocating money to where it has the highest expected return. You might hear him say something like: “I’m looking for a place where my money can work for me in the most profitable way possible”

2: OPT and OPM

The number one difference between the left side of the cashflow quadrant and the right side is OPT and OPM.

OPT stands for other people’s time.

OPM stands for other people’s money.

A person from the B quadrant uses OPT and OPM when he is designing a business system where he can hire people from the E and S quadrants, while using money from people of the I quadrant. Typically, he also invests a lot of his own time to kick-start the business, but in the long run this is not essential, and becoming a more passive owner of the business is possible.

A person from the I quadrant uses OPT to generate income from his money alone. And if he’s skilled enough, he can typically apply other people’s money as well as his own money to scale his investment profits.

Herein lies the big difference. People from the E and S quadrants never get to use OPT or OPM. Therefore, the more successful they become in their quadrants, the more money they make, but at the same time – their workload increases.

3: The Pros and Cons of the Quadrants

E: the Employee

Pros:

- Reduced financial uncertainty

- Paid vacation

- Health insurance (and other benefits)

- Colleagues.

Cons:

- Success means more work and less free time.

- Your performance is often higher than your salary (if you are not a slacker that is).

- Colleagues – especially bosses!

S: the Small Business Owner or Self-Employed.

Pros:

- You are your own boss.

- You’re paid according to performance.

Cons:

- Success means more work and less free time.

- And financial uncertainty – you might lose money on this.

B: the Big Business Owner

Pros:

- OPT and OPM.

- Financial freedom can be achieved very quickly.

- And a greater portion of your profits goes to you (in other words you pay less tax).

Cons:

- Financial uncertainty – you might lose money.

- It requires a different set of skills than what school teaches.

- And you’ll have to manage people.

I: the Investor

Pros:

- OPT and OPM.

- Financial freedom can be achieved quickly.

- A greater portion of your profits goes to you (in other words less tax)

- And it can be passive.

Cons:

- Financial uncertainty – you might lose money.

4: Breaking the Addiction - Moving to the Right Side.

So there are pros and cons with all the quadrants, but the right side is where financial freedom can be achieved the fastest. Therefore we might ask ourselves: “How can we move to this side?”

Money has an addictive power – much like sex or drugs. Therefore, when you earn money through a specific quadrant, you’ll be addicted to that quadrant. If you earn money as an employee for a large company, for instance, your brain will associate that type of work with a cash reward.

Switching from one quadrant to another becomes more difficult because of this. Moreover, if you’ve been raised in a family where degrees, job security, paid vacation and governmental pension has been highly valued, you might have a difficult transition to make.

Here are some potential mental obstacles for the conversion:

- “Argh! You are taking too many risks!”

- “You might fail!”

- “Money can’t buy happiness anyways!”

As if this wasn’t enough, our educational system is built so that it rewards those who make the least number of mistakes, and punishes those who make the most.

In the B and I quadrants you must act in the complete opposite way. People who take action will also make the most mistakes, but in the long run, these people will learn more and achieve more as business owners and/or investors.

Thomas Edison was criticized for making 1014 mistakes before creating the electric light bulb. In response, he said: I did not fail 1014 times! I successfully found out what did not work 1014 times.

The transition won’t be easy, but a great start is to surround yourself with people who have made the journey before, and learn from those that are already successful in B and I quadrants.

5: The Five Levels of Investors

According to Robert Kiyosaki, there are 5 different levels of investors. Starting from the bottom, we have:

1. The zero-financial intelligence level. At this level, we have the people who have nothing to invest at all. Each month, their expenses are higher than their income – often because they forget to pay themselves first, which is the most fundamental strategy for wealth building taught in the classic The Richest Man in Babylon.

2. The-savers-are losers level. Placing hard-earned money under a mattress or in a low-interest bank account, will put you in the top 50% of people financially. But that doesn’t mean that it’s a solid personal finance plan. Why? Because of inflation. Between 1980 and 2017 the value of the Swedish crown was reduced by 69%, for instance.

3. The I’m-too-busy level. A lot of people are simply too busy with their careers, family, friends and vacations to dedicate time to investing. They therefore hand over their money to someone else to do it. The problem with this approach is that such a person will never learn how to invest.

4. The I’m-a-professional level. This is the do-it-yourself investor. He uses his own money and takes his own decisions. He is educating himself in the subject, but hasn’t evolved to the last level yet. As you are watching this channel, I expected you already are at this level (or higher!) or that your intentions are to get here.

5. The capitalist level. This is an investor who comes from the B quadrant and has learned how to use the concepts from there in his investing.

- For example, he is not investing alone. He has advisors that help him gather information about the markets, and in that, using OPT. Furthermore, he uses OPM as well as his own money. He has also learned how to use corporations to reduce taxation levels of his capital gains.

The level 5 investor is the person who will reach financial freedom first among all of the investors.