In the following video summaries you''ll learn exactly what the rich teach their kids about money that the poor and middle class do not.

Animated Video Summary by Productivity Game

Key Takeaways

"If you work for money, you give the power to your employer. If money works for you, you keep the power and control it."

Both men worked hard and earned good incomes but his biological father struggled to pay bills his whole life well his friend’s father became one of the wealthiest men in Hawaii.

Two Fundamental Differences Between Rich Dad and Poor Dad

1. Poor Dad acquired liabilities. Rich dad acquired assets.

Assets produce income and liabilities create expenses.

Poor Dad

Most of Poor Dad’s income went to paying down those expenses.

Rich Dad

Rich Dad gradually increased his asset column, while keeping his living expenses to a minimum.

He drove a beat-up truck instead of taking out a loan to buy a new truck. He lived in a modest home and paid as little rent as possible.

When Rich Dad eventually bought a nice home and a nice car, he didn’t pay for them, his assets did. The recurring income from his businesses and his rental properties took care of his new home expenses and car payments.

Poor dad worked for money. Rich Dad made money work for him.

Kiyosaki only bought his dream car when he had enough income coming in from his rental properties to cover the monthly expenses from his Porsche.

Don’t focus your efforts on increasing your paycheck. Focus your efforts on acquiring assets.

Look for good income generating assets in four areas:

1. Businesses that can be managed by other people.

Rich Dad owned several businesses that were run by other people. His businesses require just a few hours of his time each week.

"If you have to work in a business, it's not a business, it's a job."

See the book summary on E-Myth Revisted to learn more.

2. Stock and bonds that appreciate and pay dividends.

3. Income generating real estate.

- like town homes, apartment complexes, storage units and commercial buildings.

4. Royalties on products and intellectual property

- like music, art and patents you create or buy the rights to sell.

"The measure of a person's wealth is the number of days they can survive without having to work."

- For example income from stocks held for more than a year are taxed at 15% instead of at the income tax rate which can be as high as 37%.

- Real estate gains are not taxed at all if you use them to buy more real estate thanks to the 1031 tax deferral in the United States

- Assets purchased through a personal corporation, which is how most rich people purchase assets, are taxed at a lower corporate tax rate.

2. Poor Dad was a type 1 investor. Rich dad was a type 2 investor.

Type 1 Investors

Type 1 investors are too “busy” to come up with an investment strategy, so they just keep their money in a savings account, which doesn’t keep up with inflation or they give their money to a financial advisor who invests in high commission mutual funds.

Type 2 Investors

Thanks to the wisdom passed down by Rich Dad, Kiyosaki became a type 2 investor.

He also found rental homes in housing markets that were trending up and sold them for a significant profit three to five years later.

- For example, Kiyosaki bought a small rental property in Oregon when California was having a housing boom. Gradually buyers in California started coming into Oregon and drove prices up so Kiyosaki sold his property for a profit and used the money to buy a bigger rental property in Phoenix which had a depressed housing market at the time but was trending upward.

Become a type 2 investor by developing your financial IQ.

When you have high financial IQ your mind is able to see investment opportunities that other people can’t see.

"There is gold everywhere, most people are not trained to see it."

Animated Video Summary by the Swedish Investor

Key Takeaways

The problem with financial education is that it isn’t taught in schools, so the family decides to teach it.

The problem with this is, unless your parents are in the top 1%, they are going to teach you how to be poor, not because they don’t love you, they just don’t know what they’re teaching and they don’t read books about money.

Lesson 1: The Rich Don’t Work For Money - Stop focus on your income - focus on your assets

The rich don’t work for money because they find a way to have money work for them. You can only earn so much working by the hour or on salary. The secret is to find a way to make money work for you.

Study hard, so you can get a good job at a great company. No, study hard so you can find great companies to buy. Robert Kiyosaki’s poor Dad had a PhD, but was always a struggle with money. His rich dad didn’t even finish high school and yet, he had an abundance. His PhD-dad studied so many years just to get a few hundred extra in salary every month. On the other hand, his rich dad used those years to start acquiring assets.

The rich focus on their asset column, while everyone else focuses on their income statement.

- If the average person were to get a pay cut by 2%, he would be furious. On the other hand if he loses 2% in the stock market (which is his assets) he shrugs it off by blaming bad luck or bad asset managers. Yet, for some people, it’s a worse situation to lose 2% of their assets than to lose 2% in salary. Salary levels are taken personal, while asset levels are not. This is a common problem for poor people. Start to take responsibility of your investment decisions!

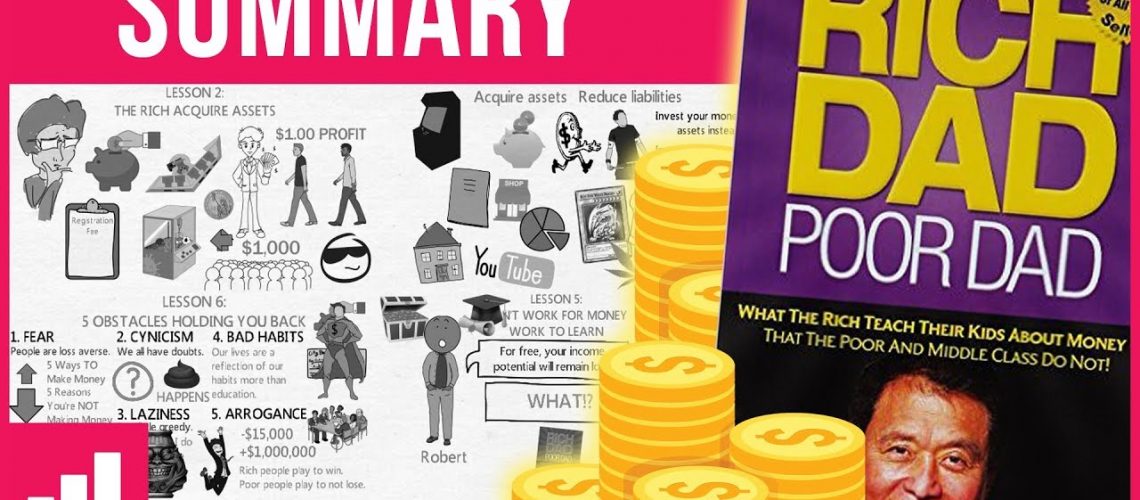

Lesson 2: The Rich Acquire Assets

Rich People Buy Assets, Poor People Buy Liabilities That They Think Are Assets

Rich people develop and acquire more assets, reduce liabilities. Assets put money in your pocket and liabilities take money out of your pocket. Assets make money work for you. The different types of assets you can acquire are abundant: rental homes, ebooks, businesses, stocks, monetize youtube videos, etc. Instead of wasting your money, invest in assets.

Asset vs Liabilities Unless you make a paradigm shift about what you do with your money, which is to buy actual assets, no matter how much income you earn from your job, you will just match it with your liabilities and expenses. You may look rich with your fancy car, but you will never actually be rich.

It’s not how much money you make, it’s how much money you keep. You get taxed when you earn, you get taxed when you spend, you get taxed when you save and even get taxed when you die. Operating from the assets quadrants and you could get away with spending 0% in taxes.

My house is my greatest investment! My house is a liability, if your house is your greatest investment, you have problems. If you want to be rich this is the main thing that you need to know. It’s that simple.

People in general don’t know what an asset is. Let’s do a little test. Is your recently bought iPhone an asset? It isn’t. Is your BMW an asset? Nope, definitely not. Is owning a part of a company an asset? Yep. Absolutely. Is your house an asset? It isn’t. Did you get 4/4?

An asset is something that puts money in your pocket. A liability is something that takes money out of your pocket.

Let’s look at how a rich person acts when making money compared to a poor person. The rich gets their income and straightaway they buy assets. They buy assets such as stocks, bonds and real estate. Now, in the long run, these resources will create even more cash for them in the future.

The middle class earns their money from a good job, but the moment they get their salary, they spend it on liabilities which they think are assets. Possessions such as TVs, cars and vacation homes. You might look rich and your friends might admire you for it, but you will never actually be rich practicing this.

But isn’t it risky to be in the stock market? What if there’s another financial collapse? It’s funny how people somehow justify buying an expensive car, which is a guaranteed money loss, while they think that buying financial assets is stupid because you might lose money. It’s crazy!

Lesson 3: Taxes & The Power of Corporations

Corporations can pay expenses before being taxed. A corporation spends everything that it can and is taxed on anything that is left. Because of the legal loopholes, you could reinvest taxes back into the business before the taxman could get their hands on it.

The rich should pay more in taxes to take care of the less fortunate. Taxes punish the productive and support the unproductive. I guess that you’ve all heard the story about Robin Hood, you know the guy who takes from the rich and gives to the poor? Inspired by this tale, the poor and the middle class invented taxes.

The purpose is to create a more equal society where everyone is included. The problem is that the rich, they’re too smart for this and in the long run, instead of taking from the rich and giving to the poor, the effect has become more like taking from the middle class and giving to the poor.

Rich people are too smart for the system and they find all types of ways and vehicles to protect their hard-earned money. One such vehicle is corporations. Corporations are good for two things primarily.

First and foremost, it allows you to pay less tax. The number one expenditure of the average household is taxes. It isn’t uncommon for people to work between January and May for the government. People often pay up to 40-50 percent in taxes. People tax before they get their salary, when buying things and even when they die!

Warren Buffett, who’s the third wealthiest man on this planet is famous for paying less tax than his secretary. What a corporation allows you to do, is to pay for expenses before paying taxes. You’re also allowed to deduct VAT from the sales by the same amount as your procurements. This effectively allows you to buy stuff for as low as 50% of the original price.

- For instance, an expensive dinner together with your girlfriend could be bought through your company and be half as expensive as for those without a company. Naaah, just kidding, don’t do that, that would be illegal, as the dinner has nothing to do with your company. At least if you get caught, don’t blame it on me. I never advised you to do it.

- The second thing that corporations are good for is to protect yourself from personal lawsuits, which could be devastating for personal finance. With an LLC or an “Aktiebolag” in Swedish, you are protected from such risks and the downside is limited to your company, not your personal wallet.

- Imagine that you’re a shop owner that is selling boat supplies. A group of Swedish Vikings raids your shop and steals everything. Your oars, your best wood and your super hot secretary. The family of the secretary decides to sue you for being irresponsible. Who in the world would announce free mead outside their shop during times of Viking invasions? You lose in court because of your carelessness, which would force you to file for personal bankruptcy, if you were without a company. In this case though, you had one, and the lawsuit is limited to the company.

Lesson 4: Increase Your Financial Intelligence

The love of money is the root of all evil. The lack of money is the root of all evil. Money is a form of power. Even more powerful though, is financial education. Money without financial intelligence is money soon gone.

This is the reason why famous people such as 50 cent and Mike Tyson have been filing for bankruptcy, even though they’ve earn big time. One of the reasons why the rich get even richer, the poor get poorer, and the middle class struggles in debt is because the subject of money is taught at home, not in schools.

Many of us learn personal finance from our parents. This means that if your parents aren’t rich already, you need to start getting advice from somewhere else on how to do it.

There are 4 parts of financial literacy that you should focus on:

1. Accounting the ability to read numbers – be it numbers from an annual report, or from your personal bank account.

2. Investing the science of making money

3. Understanding Markets At least, you should understand the basic rules of supply and demand.

4. The Law the awareness of accounting, corporate, state and federal regulations. Understanding the tax advantages and personal protection provided by corporations.

Don’t be afraid to spend your money on education that will improve your knowledge and develop skills necessary to beat your weaknesses. They author spend many thousands of dollars throughout his life on seminars, books, and so on. And guess what? The returns from these investments are unmatchable!

Arrogant people often find this hard to do. They already know everything, and rather talk about what they know than try to learn something new. Listening is more important than talking. If that weren’t true. God would not have given us two ears and only one month.

Lesson 5: Don’t Work For Money, Work to Learn

It doesn’t matter how hard you work, if you’re not willing to work to learn a new skill, even if you have to work for free, your income potential will remain low.

Lesson 6: 5 Obstacles Holding You Back

1. Fear people are loss averse. Were more afraid of losing something, than gaining something. Rich people understand loss aversion and take controlled risks.

2. Cynicism we all have doubts. Rich people understand that shit happens. Identify profitable opportunities that cynics miss.

3. Laziness to overcome this obstacle you need to be a little greedy. Without that little greed, progress would not be made.

4. Bad Habits our lives are a reflection of our habits more than our education.

5. Arrogance there are countless people in the world of money, finance, and investments who have absolutely no idea what they are talking about. When you know you’re ignorant, start educating yourself. “What I know makes money. What I don’t know loses money.” Rich people play to win, poor people play not to lose.

Lesson 7: 9 Final Tips For Wealth

1. The biggest asset you have is your mind. Invest in it.

2. Failure inspires winners and defeats losers.

3. Surround yourself with people who are smarter than you.

4. Listening is more important than talking.

5. Profits are made when you buy, not sell.

6. It’s rare that the asking price is lower than something is worth.

7. When aiming to become rich, find a higher reason.

8. There is gold everywhere. Most people are not trained to see it.

9. Saying “I can’t afford it” shuts down your brain. Asking “How can I afford it?” opens up your mind and triggers your creativity to find a way.

Lesson 8: Don't Diversify With Too Little Money

When it comes to money, just play it safe. No, learn how to manage your risks. There is no reason to diversify your portfolio if you only have a small fortune.

If you want to become rich, you must first be focused. Look at the top 5 richest people in the world. These are rankings from 2018:

- Jeff Bezos, net worth: 112 billion. Owner of Amazon.

- Bill Gates, net worth: 90 billion. Owner of Microsoft.

- Warren Buffett, net worth: 84 billion. Owner of Berkshire Hathaway.

- Bernard Arnault, net worth: 72 billion. Owner of LVMH.

- Mark Zuckerberg, net worth 71 billion. Owner of Facebook.

- Stefan Persson, net worth: 17 billion. Owner of H&M.

These people became rich, not by being diversified, but by being focused. Don’t do what the poor and middle-class do, which is to put their few eggs in too many baskets. Instead, focus, and put them in a few ones.

If you’re savings are small compares your annual salary, I think this is especially true. Aim to get a yield that will have an impact on your life and go for diversification as soon as you’ve acquired wealth that will be tough to earn back through your daily job.

In finance theory, it’s argued that diversification reduces risk, but I would argue that risk is a result of uncertainty, which in turn is the consequence of a lack of knowledge. Stay focused and you will have time to gather more info about each of your investments, and in turn, reduce your risk while keeping a high potential.