How to earn more, save more, and live a rich life. No Guilt. No Excuses. No BS. Just a 6-Week Program That Works.

Animated Summary by OnePercentBetterand the Swedish Investor

Key Takeaways

Ramit Sethi’s, “I Will Teach You To Be Rich,” is based on the four pillars of personal finance—banking, saving, budgeting, and investing-and the wealth-building ideas of personal entrepreneurship. He shows you that you don’t have to be perfect to be rich.

This proven system explains money mistakes, automating finances, hidden income and saving money, investing, eliminating debt and learning to earn more money with the skills you already have.

Lesson 1: Forget Budgets

Forget budgeting and create a conscious spending plan which involves four major categories and you contribute and certain % of income to each category.

1. Fixed Costs (50%-60%) rent, food, bills, taxes, debt etc.

2. Long-Term (10%) Investments superfund 401k, roth IRA, index-funds, etc

3. Savings (5-10%) wedding, holiday, down payment

4. Spending Money (20-35%) guilt-free spending money on anything you want

If you’re struggling, use this as a theoretical guide, otherwise focus on earning more money and not saving. You could negotiate a raise, get a higher-paying job or do freelance work. They key to a successful plan is to be frugal, not cheap.

Lesson 2: Make Your Accounts Work Together Automatically

By spending a few hours upfront, you can save a ridiculous amount time over the long-term by automatic your finances.

Lesson 3: The 6 Commandments of Credit Cards

1. Pay off your credit card regularly

2. Get all fees waived on your card

3. Ask credit card company to lower your APR

4. Keep your cards active over time

5. Get more credit

6. Use your rewards

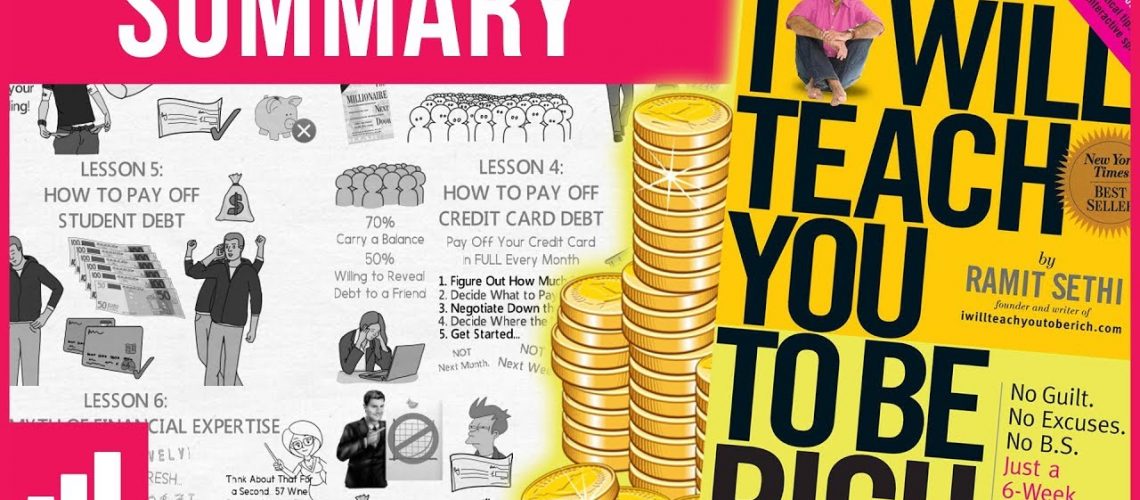

Lesson 4: How to Pay Off Credit Card Debt

The single key to using credit cards effectively is to do what you can to pay off your credit card in full every month.

5 Steps to Ridding Yourself of Credit Card Debt:

1. Figure out how much credit card debt you have

2. Decide what to pay off first

3. Negotiate down the APR

4. Decide where the money to pay off your credit cards will come from

5. Get started now

Lesson 5: How to Pay Off Student Debt

Paying off a little extra each month can save you years of payments. Only do this once you’ve cleared more expensive debts. Try to pay at least $50 more each month. It gives you a psychological victory and you’ll be able to focus on investing sooner.

- Call your lender and ask them how they could help optimize your monthly payments. By making one phone call you could save hundreds of dollars.

Lesson 6: The Myth of Financial Expertise

All of our lives, we have been taught to look up to experts, but ultimately, expertise is about results. Any financial expert that tries to predict the market are often no better than amateurs. You cannot predict the future.

Just because a fund manager got you an 80% return this year doesn’t mean he can next year. Experts can show their good results, but leave out their bad ones. This is known as a survivorship bias

Lesson 7: A Rich Life Isn’t All About Money

Two critical questions:

- Why do you want to be rich?

- What does being rich mean to you?

"Anyone can be rich. It's just a question of what rich means to you."

Becoming rich isn’t something that only happens to Ivy League graduates, elite athletes or lottery winners. Anyone can become rich. What you need to do is to define what being rich means to you.

You must start today. You must focus on a few areas of your personal finances where you can achieve big wins, instead of clipping coupons and saving on $3 lattes. Then you must set up an automated money system and start to invest. After the first set up, you will be spending no more than 90 minutes on your personal finances per month.

1. What Does Rich Mean to You?

You must decide what being rich means to you and become a conscious spender who prioritizes. It’s 100% okay to spend unapologetically on the things you love as long as you cut down costs on other stuff. Heck, even Mike Tyson who earned hundreds of millions has been in financial trouble because he didn’t spend consciously.

It’s all too easy to get lost and try to mindlessly keep up with your friends – it can be a full-time job in itself, but you must remember that there’s always a trade-off. Sure, you may be able to pick that house that costs $100,000 more, but in that case you may have to say no to buying that new Tesla.

- Take Mary as an example: She spends $6,000 a year on designer shoes with a $50,000 take-home salary. Do you think that she has control over her personal finances and that she is on a path towards an early retirement? She is! Because she shares an apartment with a friend and because she uses public transport she can easily afford to spend lavish sums on what she loves, which is designer shoes, and still be on her way towards financial success.

There’s power in saying no to things we do not like or need and there’s even more power in saying yes to the things we love.

2. Beware the Minutia

Benjamin Franklin famously said: “don’t put off until tomorrow what you can do today.” Do you want to know the single most important thing to get rich? Starting early. Sure, the best time to start was probably ten years ago for most of us, but you know what? The second best time is today.

For example, here’s something that you probably can do today: Set up an online savings account with no fees, no restriction on withdrawals, and high interest rate. Simply Google: “high interest rate savings account in …..”

But here’s where a lot of skeptics and procrastinators stop. How can I be sure that this is the account with the highest interest rate? This is just an excuse not to get started. More is lost from indecision than from mediocre decisions.

Ramit Sethi teaches something he calls the “85% solution.” He says that he would much rather get it 85% right than do nothing at all. Another excuse towards setting up that account today may be: I only have $100, why bother setting up an account that will generate just a few dollars per year?

It’s important to notice that no amount is too small when you are forming great money habits. In fact, the perfect time to start is now because the stakes are low.

A recently formed band shouldn’t decline an invitation to a smaller festival just because they dream of filling the Madison Square Garden at some point in the future. They should view it as an opportunity to practice and get better.

Likewise, you can’t expect to handle millions well, if you are struggling with hundreds of thousands. Beware the minutia. You don’t have to get it perfectly right the first time, but you must start at some point. And today is a great day for that!

3. Swap Your Attention from Micro to Macro

Have you ever heard this before? Save on three dollar lattes! Get a temporarily .1% better interest rate by switching to Ally Bank! Clip coupons! Remit Sethi has a big emphasis on macro over micro decisions. These three examples represent micro decisions.

While you may feel like you’re automatically a part of the lean FIRE movement by involving yourself in such activities, this is not where the battle is won. This is like the pro environmentalist who keeps harassing you about cooking your food with a lid on, but flies transatlantic at least four times per year.

We should focus our energy on five to ten things that really matter that will yield exceptional results and good return on invested energy.

Here are a few of those big wins:

- Automating your money system, more on this in the next takeaway –

- Keeping a great credit score – Using credit cards to get free cash backs and rewards.

- Contributing towards a 401k to get at least the full employer match.

- Paying off your credit card debt.

- Cancel your subscriptions and instead buy monthly. If you want to watch a specific series on, say Netflix for instance, you can pay the subscription for 30 days and then instantly cancel. You’ll have time to watch that series that you created the account for but, you won’t end up paying for a product that you’re not using, say three months down the line.

- Focus on cutting your costs in a few problem areas rather than a little bit here and there.

- Negotiating a raise.

- Doing freelance work.

- Buying a house that you can afford.

- Buying a car that you can afford and focus on total cost of ownership rather than the price tag.

- Allocating your capital right, more on this in the final take away.

Feel free to use this as a checklist. If you can get 5 to 10 of these rights, you can buy however many $3 lattes that you want.

4. Set Up Your Automatic Money System

We humans are weak, at times. We get distracted, bored, unmotivated etc, which endangers our prior investing efforts and saving habits. You think that you care, but that’s probably just right now. In two weeks it will be back to watching cat videos and Netflix again. Therefore, we must set up an automatic money system that can save us from our worst selves.

This system will make sure that we stick to our long-term money plan by allocating our income each month for us. Creating an automated money system is a way of doing some work right now to reap a lot of benefits for years and years to come.

For your system you’ll need:

Checking account This is where the money goes first. Think of it kind of like a distribution center. Its main purpose is to feed your other accounts appropriate amounts by using automatic transfers and to pay off all your bills.

Savings account This is a parking spot for short-term to midterm savings goals: Vacations, gifts, your wedding, a down payment on a house, etc Pick one with no fees, no restriction on withdrawals and a high interest rate.

Credit card Used correctly, this is a free short-term loan with rewards and perks. Get at least one which gives cash back – A retirement savings account such as a 401k or a Roth IRA, although this is country specific – An investment account. Get one from an online broker

Your automated money system must be based on a conscious spending plan which contains four buckets: Fixed costs, Investments, Savings; and Guilt-free spending. Here’s a great suggestion on what percentage of your take-home pay that these should represent:

- Fixed costs: 50-60%

- Investments: 10%.

- Savings: 5-10%.

- Guilt-free spending 20-35%

Now here’s an illustration on how you could distribute your money in order to follow such a spending plan.

- Don’t go lower than 5% towards savings and 10% towards investments, because these two buckets will be the backbone of your new rich life.

- However, if you implement a few of the big wins from takeaway number three, You’ll be able to raise these percentages in no time.

- Automation is great because we learn to live without the money — if we never see it we never get the urge to spend it.

5. The Pyramid of Investing Options

As I mentioned in the previous take away, the savings and the investment accounts will create the backbone of your new rich life. So let’s have a look at how to invest your money in there.

Remit Sethi presents three different ways to invest your money:

1. Pick your own stocks and bonds.

2. Pick your own index funds and mutual funds.

3. Invest in a target date fund.

This is the pyramid of investing options, the higher up in the pyramid, the simpler the investing process. Ramit Sethi thinks that for 99% of people, the second or third level in the pyramid is the best option.

Here’s why Ramit thinks so:

- It’s difficult for the individual investor to beat the market.

- Time spent trying to beat the market could be spent elsewhere. Have a look at the big wins of takeaway number 3 for such activities.

- For the majority of people Ramit suggests that even index funds and mutual funds are too much of a hassle. With the so called target date funds things such as diversification and asset allocation are solved for you.

- The only thing that you must do is to have your automated money system in place.

- For example, if you expect to retire in 2055 you can set up your investment or retirement account so that you buy Vanguard’s target retirement 2055 each month. Then that’s that. No more hassle and your money will experience the wonders of compound interest.

- It can also be used for specific savings goals. If you expect to get married in five years, for example, you can start buying target retirement 2025 for that specific goal.